About usPowering the decarbonisation of the energy sector.

As energy-focused investor, we are committed to applying our specialist expertise, experience, and global reach to build world-class companies, accelerate emissions reduction solutions and support a robust transition to net zero.

Vision

We’re driving positive change by accelerating innovation and taking proactive steps towards the decarbonisation of the energy sector.

We’re contributing to the resolution of one of the the most pressing issues facing our planet by:

- Meeting the growing demand for energy, whilst facilitating the energy transition

- Striving for continuous energy efficiency improvements in industrial value chains

- Replacing hydrocarbons wherever possible and researching sustainable solutions

- Reducing greenhouse gas emissions

We are committed to contributing towards achieving Paris Agreement targets on global warming through our differentiated strategy, distinctive stewardship practices, and commitment to Science-Based Targets

Values

We believe it is vital to acknowledge our shared humanity and the common challenges we face. We remain true to our traditional Norwegian concept of dugnad – working together to achieve common goals for the greater good – a core value for the global energy world of tomorrow.

The following values define our culture:

Integrity: treating others with honesty and respect

Imagination: seeking creative new solutions in everything we do

Intelligence: leveraging our knowledge and global network to benefit portfolio companies and investors

Inclusion: partnering with management and investors to maximise value creation

History

How we came to be

We began our journey in 2002. We envisioned a company that would foster innovation and business growth by supporting energy companies, in turn bringing efficiency to the market through technology-enabled products and services.

Following several years working for BP in management positions, our Managing Partner, Helge Tveit, fell in love with the idea of establishing a private equity firm. Aged just 35 and armed with an MBA from the University of Chicago and a wealth of energy industry experience, he teamed up with former Smedvig CEO, Ole Melberg with his big idea. The pair went into business and so Energy Ventures (as it was known then) was born.

Helge and Ole grew the firm with investment from Argentum, the Norwegian state private equity fund, and brought Einar Gamman into the team. With significant experience at senior executive level, Einar’s appointment cemented our management team, and we quickly exceeded our capital raising target of NOK 1 billion. In 2017 we decided to rebrand to better reflect our activities, which resulted in Energy Ventures becoming EV Private Equity.

Where we are now

When we changed, so did the world around us, and mitigating climate change emerged as one of the biggest global challenges of our time.

Historically, we have been focused on oil and gas technologies, providing operational efficiencies and cost savings to the traditional energy industry. Today, while we continue this core focus on technology, we recognise the need to respond to the modern world’s needs to drive emissions down.

Since 2020, we’re exclusively investing in energy companies that provide emissions reduction solutions.

Energy technology has been at our core for two decades. With action needed now to protect future generations from this threat, the energy sector is undergoing an immense transformation – we’re helping finance this low carbon shift.

Where we are going

Our renewed strategy to focus on the energy transition domain positions us in new markets that will grow substantially over the coming decades.

Our commitment to investing in trailblazing, high-return technologies remains unwavering. Our spirit of innovation was where we started 20 years ago, and it will continue to guide us in the years ahead.

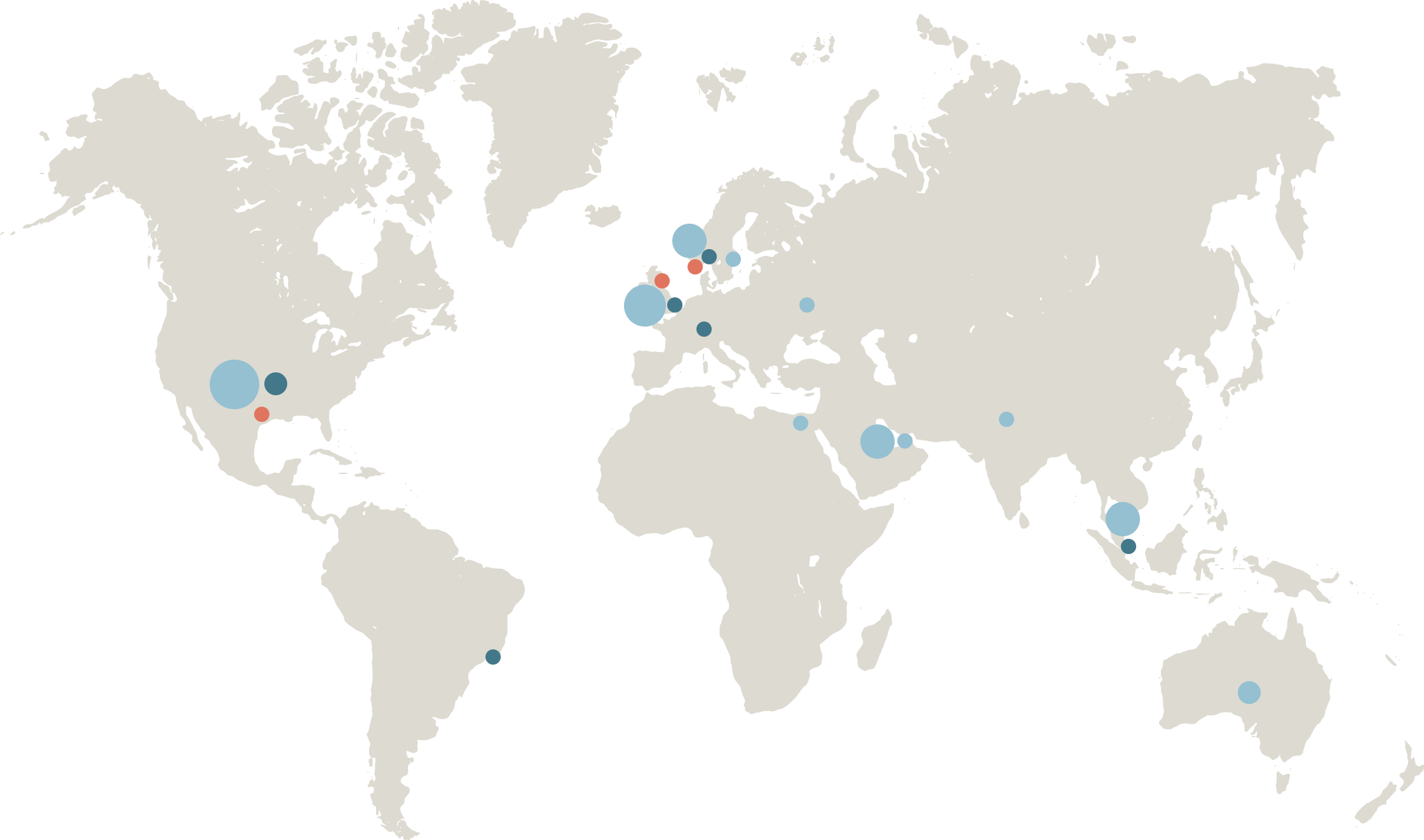

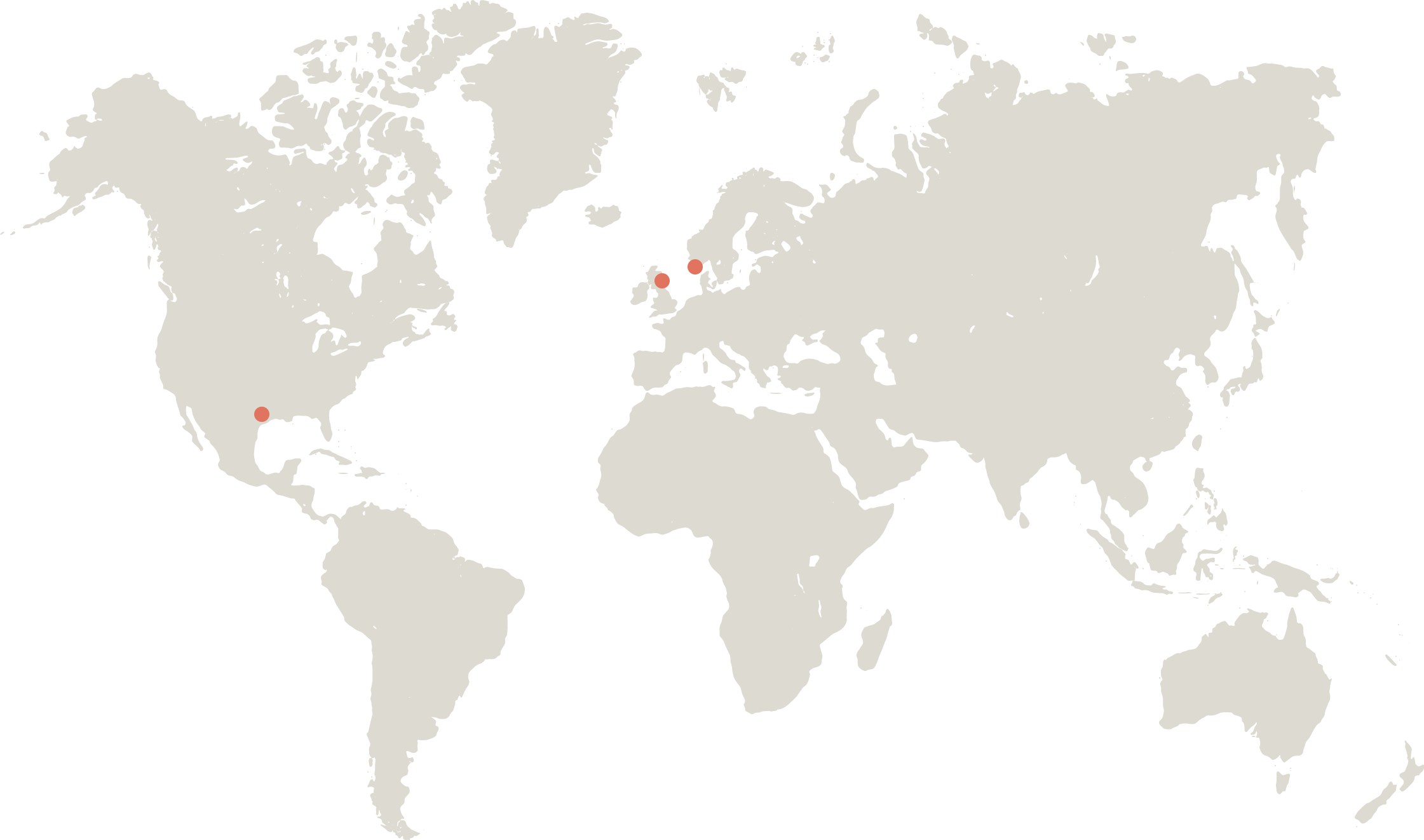

Company locations

Stavanger

Veritasveien 25

4007 Stavanger

Norway

P +47 51 84 12 95

Aberdeen

4 Albyn Terrace

Aberdeen, AB10 1YP

UK

P +44 1224 628 280

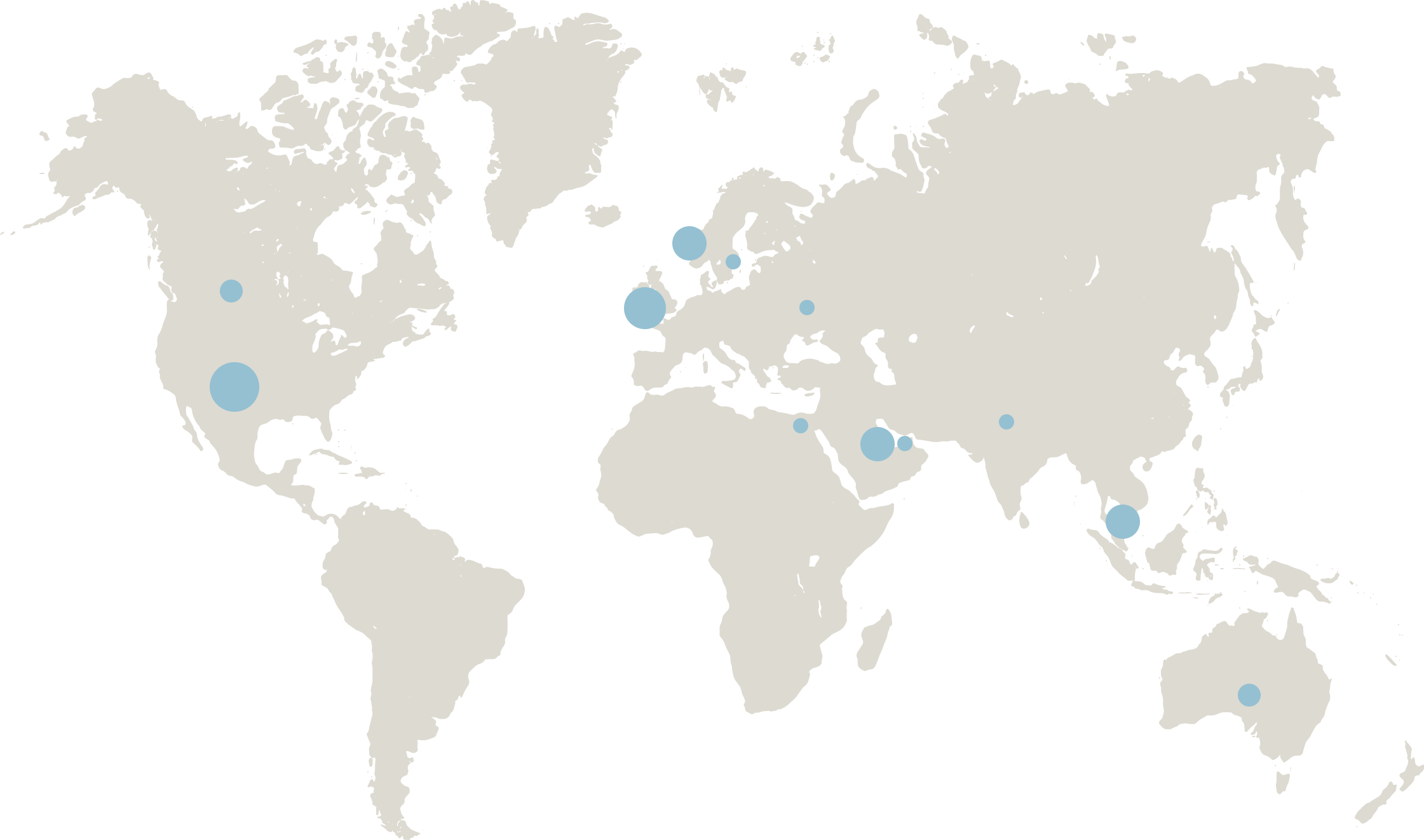

Portfolio companies

North America

Houston

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Abrado Wellbore Services provides environmentally sound oil and gas well abandonment services and technologies. Its tools and services ensure the safe and permanent plugging of wells to the highest regulatory standards. The resulting prevention of recurring leaks is environmentally sound and advantageous.

Geoteric is a seismic software company which looks beyond traditional interpreter confines. It has revolutionised seismic interpretation by using AI to complement traditional techniques and improve the quality, speed and understanding of subsurface data. It does this by presenting data in an intuitive manner so that works it tandem with the interpreter’s thought processes, enabling the unlocking of previously undiscovered or unattainable resources.

FourPhase offers specialist services to the upstream energy sector enabling post-wellhead high pressure removal of hazardous well bore solids. The proprietary technology, packaged as modular skids, is offered as a one-stop rental service. Client benefits include a lowered carbon footprint, improved safety, increased production and well lifetime extension without further CAPEX.

Halfwave offers in line inspection (ILI) services to the energy and utility markets based on a proprietary ultra-wideband acoustic inspection technology. The high accuracy, resolution and repeatability enables state of the art asset integrity practices to avoid pipeline disasters and methane leakages from mid-stream infrastructure. Halfwave was sold to Eddify NDT in February 2020.

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Rival Downhole Tools (HQ)

Rival Downhole Tools (Rival) is a technology company that provides drilling and thru tubing tools for drilling and completing oil and gas wells. Rival’s technology enables improved efficiencies and reduced downtime by seeking to eliminate the most common failures in downhole tools, thus contributing to a reduction in CO2 emissions from drilling rigs.

Reach Production Solutions (HQ)

Reach Production Solutions

Process efficiency services- HQ: US

- Stage: Early Stage

- Employees: 17

Reach Production Solutions was established in 2010 to enhance artificial lift capabilities for energy companies through its novel wet gas compression technology. The technology enables customers to continue to lift hydrocarbons from a wellbore by reducing wellhead flowing pressure, while also ensuring that all produced natural gas makes it to the central processing facility. This improves the carbon footprint of end-users by eliminating wellsite processing and trucking activities that release hydrocarbons to the atmosphere or require flaring.

Workover Solutions (WOS)

Integrated hardware solutions- HQ: US

- Stage: Growth

- Employees: 64

Workover Solutions (WOS) is a technology company which provides thru-tubing tools, service and personnel for the completion, workover, and gas storage markets. Use of WOS technology improves the efficiency rates for customer operations and reduces the use of chemicals. This results in reduced non-productive time, leading to a decrease in overall operational time.

Wireless Seismic (HQ)

Wireless Seismic

Integrated hardware solutionsSensor technologies- HQ: US

- Stage: Early Stage

- Employees: 26

Wireless Seismic manufactures the only wireless seismic data acquisition system with real-time data return, improving data quality while significantly lowering the costs and environmental impact of seismic operations.

Bluware (HQ)

Bluware’s technology uses high-performance cloud computing to increase efficiency and reduce risk in the transfer and analysis of big data using deep learning, mega-data visualization, and cost-effective cloud storage. Bluware greatly accelerates its customers’ ability to make informed decisions by removing inefficiencies in data acquisition, storage, and utilisation via a proprietary compression and compute technology called Volume Data Store (VDS) which it combines with adaptive streaming. Bluware technology is applicable to any cartesian grid signal data such as medical, electron microscopy, CT-scans, and meteorological data. By innovating to increase efficiency and reduce time to oil, Bluware is contributing to a sustainable future for the upstream exploration and production sector.

MorphPackers (HQ)

MorphPackers delivers revolutionary and highly innovative expandable steel packers. Its specialist focus on refrac packers and production packers is contributing to improved recovery rates from existing wells and more sustainable operations.

ProSep (HQ)

ProSep offers proprietary energy-efficient and environmentally friendly industrial flow mixers and solutions that enable the removal of hazardous or polluting contaminants from industrial oil, gas and produced water streams. ProSep is committed to compliance with the highest environmental standards while limiting carbon footprints through best-in-class energy efficiency.

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

Broussard

Abrado Wellbore Services provides environmentally sound oil and gas well abandonment services and technologies. Its tools and services ensure the safe and permanent plugging of wells to the highest regulatory standards. The resulting prevention of recurring leaks is environmentally sound and advantageous.

Conroe

Evolution Engineering

Integrated hardware solutionsSensor technologies- HQ: Canada

- Stage: Growth

- Employees: 60

Evolution Engineering enables the subsurface internet via its proprietary communications hardware and software. It delivers best in class reliability and cost performance in a safe and environmentally responsible manner.

Imperial

Workover Solutions (WOS)

Integrated hardware solutions- HQ: US

- Stage: Growth

- Employees: 64

Workover Solutions (WOS) is a technology company which provides thru-tubing tools, service and personnel for the completion, workover, and gas storage markets. Use of WOS technology improves the efficiency rates for customer operations and reduces the use of chemicals. This results in reduced non-productive time, leading to a decrease in overall operational time.

Calgary

Evolution Engineering

Integrated hardware solutionsSensor technologies- HQ: Canada

- Stage: Growth

- Employees: 60

Evolution Engineering enables the subsurface internet via its proprietary communications hardware and software. It delivers best in class reliability and cost performance in a safe and environmentally responsible manner.

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Midland

Rival Downhole Tools (Rival) is a technology company that provides drilling and thru tubing tools for drilling and completing oil and gas wells. Rival’s technology enables improved efficiencies and reduced downtime by seeking to eliminate the most common failures in downhole tools, thus contributing to a reduction in CO2 emissions from drilling rigs.

New York

Safran delivers world-class integrated project management and risk analysis software solutions and professional services that allow businesses to plan and execute successful projects in a timely and cost-efficient manner within the energy, engineering and construction, aerospace and defence, utilities, and public sectors. Safran’s software mitigates and minimises project disruption and scope creep, ensuring the most effective use of resources and reducing waste.

Boulder

Wireless Seismic

Integrated hardware solutionsSensor technologies- HQ: US

- Stage: Early Stage

- Employees: 26

Wireless Seismic manufactures the only wireless seismic data acquisition system with real-time data return, improving data quality while significantly lowering the costs and environmental impact of seismic operations.

Odessa

Workover Solutions (WOS)

Integrated hardware solutions- HQ: US

- Stage: Growth

- Employees: 64

Workover Solutions (WOS) is a technology company which provides thru-tubing tools, service and personnel for the completion, workover, and gas storage markets. Use of WOS technology improves the efficiency rates for customer operations and reduces the use of chemicals. This results in reduced non-productive time, leading to a decrease in overall operational time.

Mansfield

Workover Solutions (WOS)

Integrated hardware solutions- HQ: US

- Stage: Growth

- Employees: 64

Workover Solutions (WOS) is a technology company which provides thru-tubing tools, service and personnel for the completion, workover, and gas storage markets. Use of WOS technology improves the efficiency rates for customer operations and reduces the use of chemicals. This results in reduced non-productive time, leading to a decrease in overall operational time.

Hazen

Workover Solutions (WOS)

Integrated hardware solutions- HQ: US

- Stage: Growth

- Employees: 64

Workover Solutions (WOS) is a technology company which provides thru-tubing tools, service and personnel for the completion, workover, and gas storage markets. Use of WOS technology improves the efficiency rates for customer operations and reduces the use of chemicals. This results in reduced non-productive time, leading to a decrease in overall operational time.

Newfoundland

Norway

Stavanger

Add Energy Group (HQ)

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Safran (HQ)

Safran delivers world-class integrated project management and risk analysis software solutions and professional services that allow businesses to plan and execute successful projects in a timely and cost-efficient manner within the energy, engineering and construction, aerospace and defence, utilities, and public sectors. Safran’s software mitigates and minimises project disruption and scope creep, ensuring the most effective use of resources and reducing waste.

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Aquaterra Energy Group is a seabed to surface provider of engineering services, equipment sales and rental, and offshore structures, primarily focused on the shallow water oil and gas market. Its products and services have a lower environmental impact as they enable faster deployment of assets, utilising less transport and resources, and increase the efficiency of drilling operations.

Well Connection (HQ)

Well Connection

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 206

WellConnection Group is a leading provider of smart and fully integrated inspection, maintenance, and repair solutions for the energy industry, ensuring safe and efficient operations, enhanced operational uptime, and maintained integrity of life critical assets. In addition, WellConnection is a licensed expert in the safe and effective handling, treatment, decontamination and disposal of naturally occurring radioactive material (NORM) polluted equipment.

ProSep offers proprietary energy-efficient and environmentally friendly industrial flow mixers and solutions that enable the removal of hazardous or polluting contaminants from industrial oil, gas and produced water streams. ProSep is committed to compliance with the highest environmental standards while limiting carbon footprints through best-in-class energy efficiency.

Bergen

FourPhase (HQ)

FourPhase offers specialist services to the upstream energy sector enabling post-wellhead high pressure removal of hazardous well bore solids. The proprietary technology, packaged as modular skids, is offered as a one-stop rental service. Client benefits include a lowered carbon footprint, improved safety, increased production and well lifetime extension without further CAPEX.

Halfwave (HQ)

Halfwave offers in line inspection (ILI) services to the energy and utility markets based on a proprietary ultra-wideband acoustic inspection technology. The high accuracy, resolution and repeatability enables state of the art asset integrity practices to avoid pipeline disasters and methane leakages from mid-stream infrastructure. Halfwave was sold to Eddify NDT in February 2020.

Oslo

Bluware’s technology uses high-performance cloud computing to increase efficiency and reduce risk in the transfer and analysis of big data using deep learning, mega-data visualization, and cost-effective cloud storage. Bluware greatly accelerates its customers’ ability to make informed decisions by removing inefficiencies in data acquisition, storage, and utilisation via a proprietary compression and compute technology called Volume Data Store (VDS) which it combines with adaptive streaming. Bluware technology is applicable to any cartesian grid signal data such as medical, electron microscopy, CT-scans, and meteorological data. By innovating to increase efficiency and reduce time to oil, Bluware is contributing to a sustainable future for the upstream exploration and production sector.

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Halfwave offers in line inspection (ILI) services to the energy and utility markets based on a proprietary ultra-wideband acoustic inspection technology. The high accuracy, resolution and repeatability enables state of the art asset integrity practices to avoid pipeline disasters and methane leakages from mid-stream infrastructure. Halfwave was sold to Eddify NDT in February 2020.

Mongstad

Well Connection

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 206

WellConnection Group is a leading provider of smart and fully integrated inspection, maintenance, and repair solutions for the energy industry, ensuring safe and efficient operations, enhanced operational uptime, and maintained integrity of life critical assets. In addition, WellConnection is a licensed expert in the safe and effective handling, treatment, decontamination and disposal of naturally occurring radioactive material (NORM) polluted equipment.

Hammerfest

UK

Aberdeen

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Aquaterra Energy Group is a seabed to surface provider of engineering services, equipment sales and rental, and offshore structures, primarily focused on the shallow water oil and gas market. Its products and services have a lower environmental impact as they enable faster deployment of assets, utilising less transport and resources, and increase the efficiency of drilling operations.

Deep Casing Tools (HQ)

Deep Casing Tools

Process efficiency services- HQ: UK

- Stage: Early Stage

- Employees: 18

Deep Casing Tools’ (DCT) proprietary technology adds value in well construction, well completion and casing recovery. DCT’s innovations improve operational efficiency, lower well cost and reduce rig days with corresponding environmental impact savings.

MorphPackers delivers revolutionary and highly innovative expandable steel packers. Its specialist focus on refrac packers and production packers is contributing to improved recovery rates from existing wells and more sustainable operations.

Romar (HQ)

Romar´s patented technology enables efficient removal of metal cuttings (swarf) for milling operations during drilling. The improved performance of the Romar technology enables substantial cost reduction and thereby reduces GHG emissions. These innovative technologies are also used in the decontamination of drilling fluids and in spill prevention and containment.

Westwood Global Energy

Integrated hardware solutions- HQ: UK

- Stage: Growth

- Employees: 70

Home to some of the most respected solutions in energy market intelligence, Westwood Global Energy Group provides actionable insight to key upstream, unconventional, subsea and offshore sectors, through subscription-based data services, commercial analysis and advice, and bespoke research-led solutions. Its actionable data insights facilitate discoveries of new fields with low emissions intensity.

Enpro Subsea (HQ)

Enpro Subsea is a production optimisation specialist. Enpro’s proprietary solutions enable the use of smaller and lighter vessels which provides overall cost, time and emissions savings. Enpro is also the leader in OSPAR compliant characterisation and removal of cell contents for decommissioning of gravity-based structures offshore. This capability mitigates the unintended release of hydrocarbon into the sea, reducing both decommissioning costs and the resulting carbon footprint. Enpro was sold to Hunting plc. in February 2020.

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

ProSep offers proprietary energy-efficient and environmentally friendly industrial flow mixers and solutions that enable the removal of hazardous or polluting contaminants from industrial oil, gas and produced water streams. ProSep is committed to compliance with the highest environmental standards while limiting carbon footprints through best-in-class energy efficiency.

Faversham

Westwood Global Energy

Integrated hardware solutions- HQ: UK

- Stage: Growth

- Employees: 70

Home to some of the most respected solutions in energy market intelligence, Westwood Global Energy Group provides actionable insight to key upstream, unconventional, subsea and offshore sectors, through subscription-based data services, commercial analysis and advice, and bespoke research-led solutions. Its actionable data insights facilitate discoveries of new fields with low emissions intensity.

Banff

Motive Offshore (HQ)

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Kintore

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Crawley

Safran delivers world-class integrated project management and risk analysis software solutions and professional services that allow businesses to plan and execute successful projects in a timely and cost-efficient manner within the energy, engineering and construction, aerospace and defence, utilities, and public sectors. Safran’s software mitigates and minimises project disruption and scope creep, ensuring the most effective use of resources and reducing waste.

Yeovil

Safran delivers world-class integrated project management and risk analysis software solutions and professional services that allow businesses to plan and execute successful projects in a timely and cost-efficient manner within the energy, engineering and construction, aerospace and defence, utilities, and public sectors. Safran’s software mitigates and minimises project disruption and scope creep, ensuring the most effective use of resources and reducing waste.

London

Geoteric is a seismic software company which looks beyond traditional interpreter confines. It has revolutionised seismic interpretation by using AI to complement traditional techniques and improve the quality, speed and understanding of subsurface data. It does this by presenting data in an intuitive manner so that works it tandem with the interpreter’s thought processes, enabling the unlocking of previously undiscovered or unattainable resources.

Westwood Global Energy

Integrated hardware solutions- HQ: UK

- Stage: Growth

- Employees: 70

Home to some of the most respected solutions in energy market intelligence, Westwood Global Energy Group provides actionable insight to key upstream, unconventional, subsea and offshore sectors, through subscription-based data services, commercial analysis and advice, and bespoke research-led solutions. Its actionable data insights facilitate discoveries of new fields with low emissions intensity.

Norwich

Aquaterra Energy (HQ)

Aquaterra Energy Group is a seabed to surface provider of engineering services, equipment sales and rental, and offshore structures, primarily focused on the shallow water oil and gas market. Its products and services have a lower environmental impact as they enable faster deployment of assets, utilising less transport and resources, and increase the efficiency of drilling operations.

Newcastle

Geoteric is a seismic software company which looks beyond traditional interpreter confines. It has revolutionised seismic interpretation by using AI to complement traditional techniques and improve the quality, speed and understanding of subsurface data. It does this by presenting data in an intuitive manner so that works it tandem with the interpreter’s thought processes, enabling the unlocking of previously undiscovered or unattainable resources.

Sweden

Stockholm

Safran delivers world-class integrated project management and risk analysis software solutions and professional services that allow businesses to plan and execute successful projects in a timely and cost-efficient manner within the energy, engineering and construction, aerospace and defence, utilities, and public sectors. Safran’s software mitigates and minimises project disruption and scope creep, ensuring the most effective use of resources and reducing waste.

Russia

Moscow

Wireless Seismic

Integrated hardware solutionsSensor technologies- HQ: US

- Stage: Early Stage

- Employees: 26

Wireless Seismic manufactures the only wireless seismic data acquisition system with real-time data return, improving data quality while significantly lowering the costs and environmental impact of seismic operations.

MENA

Al Khobar

Deep Casing Tools

Process efficiency services- HQ: UK

- Stage: Early Stage

- Employees: 18

Deep Casing Tools’ (DCT) proprietary technology adds value in well construction, well completion and casing recovery. DCT’s innovations improve operational efficiency, lower well cost and reduce rig days with corresponding environmental impact savings.

Damman

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Sharjah

Motive Offshore specialises in the manufacture, rental and servicing of high capacity winches and umbilical testing and deployment equipment for the offshore oil and gas and renewables market. Motive’s equipment offers superior reliability while its highly-trained workforce can operate and maintain the equipment offshore. This increases efficiency and vessel uptime during operations while reducing unnecessary greenhouse emissions.

Dubai

Wireless Seismic

Integrated hardware solutionsSensor technologies- HQ: US

- Stage: Early Stage

- Employees: 26

Wireless Seismic manufactures the only wireless seismic data acquisition system with real-time data return, improving data quality while significantly lowering the costs and environmental impact of seismic operations.

Cairo

Aquaterra Energy Group is a seabed to surface provider of engineering services, equipment sales and rental, and offshore structures, primarily focused on the shallow water oil and gas market. Its products and services have a lower environmental impact as they enable faster deployment of assets, utilising less transport and resources, and increase the efficiency of drilling operations.

Asia

Thailand

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

Vietnam

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

Malaysia

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

Singapore

Westwood Global Energy

Integrated hardware solutions- HQ: UK

- Stage: Growth

- Employees: 70

Home to some of the most respected solutions in energy market intelligence, Westwood Global Energy Group provides actionable insight to key upstream, unconventional, subsea and offshore sectors, through subscription-based data services, commercial analysis and advice, and bespoke research-led solutions. Its actionable data insights facilitate discoveries of new fields with low emissions intensity.

Energy Drilling (HQ)

Energy Drilling

Process efficiency services- HQ: Singapore

- Stage: Growth

- Employees: 71

Energy Drilling develops, builds and operates the next generation of self-erecting tender assist drilling rigs. Its modern and high-specification units maximise uptime and deliver superior safety performance with a focus on proactive control of environmental impact.

New Delhi

Wireless Seismic

Integrated hardware solutionsSensor technologies- HQ: US

- Stage: Early Stage

- Employees: 26

Wireless Seismic manufactures the only wireless seismic data acquisition system with real-time data return, improving data quality while significantly lowering the costs and environmental impact of seismic operations.

Australia

Perth

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

Aquaterra Energy Group is a seabed to surface provider of engineering services, equipment sales and rental, and offshore structures, primarily focused on the shallow water oil and gas market. Its products and services have a lower environmental impact as they enable faster deployment of assets, utilising less transport and resources, and increase the efficiency of drilling operations.

Melbourne

Add Energy Group

Integrated hardware solutions- HQ: Norway

- Stage: Growth

- Employees: 230

Add Energy is an international consultancy providing robust solutions and specialised services that enable stakeholders to manage their assets in the most streamlined, logical, and cost-efficient manner within the energy, utilities, manufacturing, and maritime industries. Add Energy delivers a unique toolbox of proprietary solutions that helps increase production, improve operational efficiency, and reduce environmental footprint.

0

primary investments

Over 0

tonnes CO2e avoided in 2022 *

+0

years’ cross sector experience

0

current portfolio companies

* The amount corresponds to 3rd party assessed avoided emissions (scope 4) enabled by the technologies or services provided by our portfolio companies.